Indian Tractor Industry

The Tractor industry has always been a barometer for the state of rural economy in India. Indian tractor industry is relatively young but now has become the largest market worldwide (excluding sub 20 hp belt driven tractors used in China), accounting one third of the global production. The other major tractor markets in the world are China and US.

The Tractor industry has always been a barometer for the state of rural economy in India. Indian tractor industry is relatively young but now has become the largest market worldwide (excluding sub 20 hp belt driven tractors used in China), accounting one third of the global production. The other major tractor markets in the world are China and US.

Up to 1960, the demand of the tractor was met entirely through imports. Indigenous manufacture of tractors began in 1961. India continued to import tractors to bridge the total needs up to the late 1970 and had reached just about 50,000 units in the early 1980’s, but today the size Indian Tractor market has grown to over 600,000 units. The Indian Tractor Industry has come a long way since then. Volume growth in the past 4 decades show a CAGR of 7.5%, despite seasonal vagaries, plummeting and boosting, tractor demand and consequentially the Industry volumes.

Tractors Market Overview 2016-17

Indian tractor industryhas seen a positive growth trend during FY2016-17. While domestic volumes increased by 18.2% between April 2016 to March 2017, exports remained almost flat.

Normal monsoon has been a key driver of growth. It fuelled production and boosted farmers’ income, which eventually aided the growth in tractor demand. All key states such as Maharashtra, Madhya Pradesh, Bihar, Karnataka, Gujarat, Andhra Pradesh and Uttar Pradesh showed positive growth.

The southern region outpaced all other regions on a consistent basis over the past three years, with growth being led by a robust demand in Andhra Pradesh, Tamil Nadu and Telangana. Government support programs and improved rural sentiments helped maintain the growth trajectory in these states.

The eastern region continues to report strong volume growth in the current fiscal, albeit on a low base, benefitting from various government initiatives to boost farm mechanization.

There has been a recovery in demand in the central and western regions led by improved farm sentiments on account of estimates of improved crop production and resulting farm income.

The northern region continues to lag the pan India growth. Uttar Pradesh, the largest tractor market in the region, has recorded healthy growth. Other key markets of Rajasthan and Punjab continue to struggle, as a result of weak haulage and replacement demand respectively.

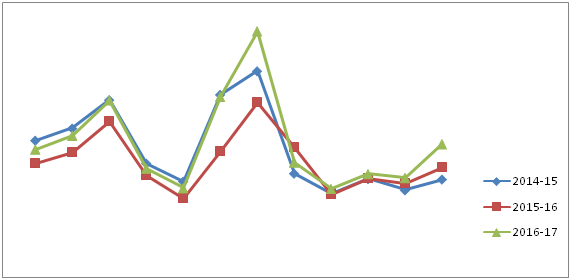

Month wise Production (FY 2016-17)

| FY | April | May | June | July | Aug | Sept | Oct | Nov | Dec | Jan | Feb | March |

| 2014-15 | 61048 | 58572 | 61805 | 61364 | 56636 | 64386 | 51912 | 50741 | 35171 | 37595 | 37297 | 36467 |

| 2015-16 | 47849 | 51293 | 57229 | 59349 | 55579 | 53619 | 54084 | 32071 | 34718 | 38447 | 41147 | 45406 |

| 2016-17 | 52481 | 57631 | 60596 | 59876 | 59438 | 62787 | 64529 | 59657 | 46707 | 45444 | 53381 | 68834 |

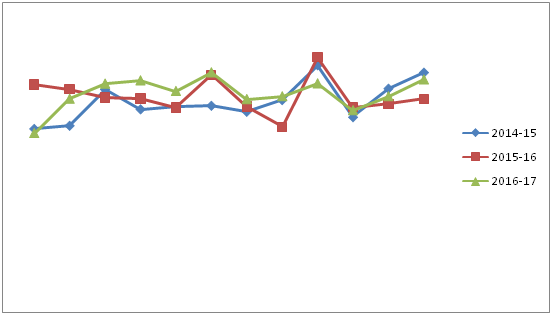

Month wise Domestic Sale (FY 2016-17)

| FY | April | May | June | July | Aug | Sept | Oct | Nov | Dec | Jan | Feb | March |

| 2014-15 | 49668 | 54625 | 66172 | 40345 | 32953 | 68353 | 77983 | 36219 | 27945 | 33964 | 29416 | 33820 |

| 2015-16 | 40244 | 44716 | 57550 | 35315 | 26074 | 45089 | 65098 | 46885 | 27898 | 34128 | 32096 | 38671 |

| 2016-17 | 46031 | 51566 | 65938 | 38248 | 30319 | 67361 | 93907 | 40763 | 30038 | 36021 | 34492 | 48160 |

The tractor exports growth, which moderated in FY2016, remained weak during the current fiscal as well; the weak demand in the global markets led to near stagnant volumes in FY2017. Although OEMs have continued to take initiatives to enhance their distribution networks in various geographies and launched products tailored for specific markets, the weak demand in the global markets constrained export volumes.

Competitive intensity in the domestic tractor market remains high; although there have been subtle changes in market share over the past few years, the market structure has remained largely similar.

Month wise Export (FY 2016-17)

| FY | April | May | June | July | Aug | Sept | Oct | Nov | Dec | Jan | Feb | March |

| 2014-15 | 5416 | 5517 | 6676 | 6042 | 6111 | 6156 | 5964 | 6338 | 7448 | 5789 | 6703 | 7216 |

| 2015-16 | 6825 | 6671 | 6409 | 6382 | 6098 | 7130 | 6125 | 5482 | 7686 | 6103 | 6208 | 6366 |

| 2016-17 | 5265 | 6367 | 6851 | 6957 | 6616 | 7212 | 6354 | 6445 | 6859 | 5998 | 6445 | 6982 |

Conclusion

Currently low levels of tractor penetration in India, strong governmental focus on availability of finance for agriculture mechanization tools and on rural development and high irrigation potential will drive the overall growth of the tractor industry. In addition, government initiatives such as the implementation of National Rural Employment Guarantee Act (NREGA) and increased usage in non-agricultural domains such as haulage in construction and infrastructure projects will further increase demand of tractors. Also, many manufacturers are introducing new models of tractors into the market to leverage the growing demand.